Latest NEWS

- Aswat Masriya, the last word

- Roundup of Egypt's press headlines on March 15, 2017

- Roundup of Egypt's press headlines on March 14, 2017

- Former Egyptian President Hosni Mubarak to be released: lawyer

- Roundup of Egypt's press headlines on March 13, 2017

- Egypt's capital set to grow by half a million in 2017

- Egypt's wheat reserves to double with start of harvest -supply min

- Roundup of Egypt's press headlines on March 12, 2017

Egypt inflation expected to remain high as pound devaluation looms - Moody's

CAIRO, Sept 28 (Aswat Masriya) - Egypt's inflation rates are expected to "remain elevated" in the upcoming fiscal year as plans to devalue the pound and introduce subsidy fuel reforms loom, Moody's said on Wednesday.

The annual consumer inflation rate jumped to 16.4 percent in August, marking a significant rise from the previous month, according to the Central Agency for Public Mobilization and Statistics (CAPMAS).

Moody's Investors Services said that economic and fiscal reform momentum supports Egypt’s B3 rating and stable outlook.

Real GDP growth is projected to average only 4.2 percent over 2016-2020, compared to the 6.2 percent average growth recorded between 2006 and 2010, according to Moody's report.

"Although still below pre-revolution levels, economic growth has started to pick up, and investor sentiment has improved," says Steffen Dyck, a Senior Credit Officer at Moody's.

Growth is mainly driven by private consumption, while public and private investment are also expected to provide support. However, negative net export growth is expected to persist for the coming years as capital goods imports increase coupled with a weak global demand for Egypt's exports, according to Moody's.

"We also expect that high fiscal deficits and government debt levels will gradually reduce. The domestic market continues to provide a sizable funding base for the government," Dyck said.

Egypt's external debt has reached over $50 billion, and is expected to be almost double this amount as the country negotiates a lump of loans from the World Bank and the African Development Bank to secure funding for the upcoming period.

In August, Egypt reached staff-level agreement with the International Monetary Fund (IMF) over a three-year $12 billion funding facility aimed at cutting the budget deficit and improving the currency market. The agreement is expected to be finalised within the coming weeks.

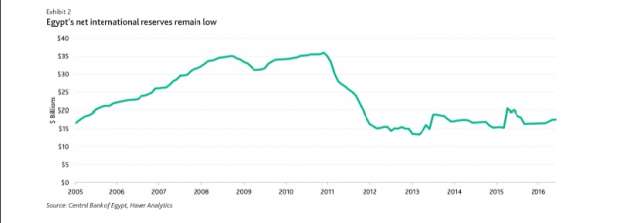

In another report, Moody's said that Egypt's external payments position remains fragile despite a slight rise in foreign reserves in recent months.

The current account deficit reached $14.5 billion from $8.3 billion the previous year, while the overall balance-of-payments deficit more than tripled to $3.6 billion from $1.0 billion.

"The widening deficit is credit negative because it reflects underlying structural weaknesses and increases external vulnerability risks," Moody's stated.

Egypt's net foreign reserves rose to $16.564 billion at the end of August, still less than half the reserves held before the January 2011 uprising which ended Hosni Mubarak's 30-year rule.

Moody's said the security risk has declined to an extent, but could possibly elevate amid high unemployment rates, expected subsidy rationalisation and tax hikes that will lead to rising inflation rates and consequently public discontent.